If you have spend sometime in Stock market, you would have come across India VIX indicator whenever panic strikes. So what does it mean and what it represents?

The Indian Volatility Index in short is referred to as India VIX. As name suggests, this index measures the volatility of the market. Index helps in understanding if the market participants are feeling fearful or complacent about the market in the near term.

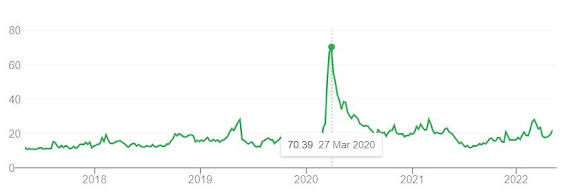

It indicates the degree of volatility or fluctuation traders expect over the next 30 days in the Nifty50 Index. India VIX was introduced by the NSE in 2008, but the concept was originally introduced by Chicago Board Options Exchange in 1993.

Expert note - If you are interested in learning the mechanism of calculation, refer to NSE for technical information.

How to interpret India VIX?

Say the India VIX value is 21.88. This means that the traders expect 21.88 per cent volatility for the next 30 days. In other words, traders expect the value of the Nifty to be in a range between +21.88 per cent and -21.88 per cent from the current Nifty value for the next year over the next 30 days.

You can easily understand the importance of India VIX as indicator, when you see the Index over COVID panic start - going up to almost 70.

0 Comments

Your comment is appreciated. I look forward for your views / feedback / suggestions.