CAGR or Compounded Annual Growth Rate refers to the mean annual growth over given period of time. To simply put, it shows the average annual return generated over a period of time thereby smoothing out any spikes or drops from the return over a period.

Let's take an example - you invested in a stock "A" at the beginning of year 2019 at Rs 1,000 and at end of year 2020 it's trading at Rs 500 and now at the end of 2021 its trading at Rs 3,000. How do you compute your average annual return? This is wherein CAGR comes to play, helping you smooth out the fluctuation to show your average return over 2019 to 2021.

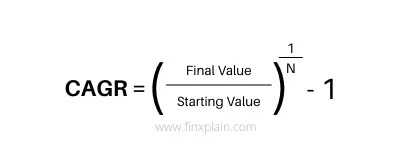

How to calculate CAGR?

CAGR can be computed using above formula where in N refers to the number of years. Going back to our previous example, number of year would mean 2 years (2019 starting to 2021 end), Starting Value will be Rs 1,000 and Final Value will be Rs 3,000. Once calculated, you will get return of ~73.2%.

Calculating CAGR using EXCEL -

You can use Excel's inbuilt formula of RRI. It has three arguments (number of years NPER, present value PV and final value FV).

So to calculate our example, your formula would be =RRI(2,1000,3000)

Always remember, while comparing CAGR between two stocks / investment / any item; numbers of years are equal. Else, you will be comparing apple to oranges.

0 Comments

Your comment is appreciated. I look forward for your views / feedback / suggestions.