What is Dividend?

Companies distribute a portion of their profits to shareholders, which is called dividend. In Indian market, dividends are generally issued as Interim or Final. Interim means dividends issued during the year, while Final dividend means the amount issued at the close of the financial year. [Confused about different dividend dates? Read here]

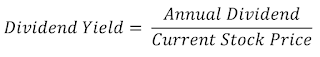

Dividend yield is always expressed as a percentage (%) – this is the ratio between dividend and stock price. This is used to measure the amount of cash Dividend company pays as a % to it’s stock price.

Understanding this % a bit more

It’s important to remember, the stock price will vary at any given point of time – this makes the Dividend Yield % very dynamic. For instance, a Company is issuing Rs 10 as annual dividend, when the stock price is at Rs 200 – dividend yield would be computed as 10 / 200, i.e. 5%. Now if Company’s stock price drops to Rs 100 and still continues to issue Rs 10 as annual dividend – dividend yield would be 10% (i.e. 10/100). You can see, there is huge growth in dividend yield % at cost of drop in share price.

Myth

High dividend yield are safe. This is absolute myth - classic case in Indian market is Coal India. Following chart says it all:

Important

You can check out the list of Government companies having high divided yield here at StockXplain site.

0 Comments

Your comment is appreciated. I look forward for your views / feedback / suggestions.